The factors that impact on a company’s performance are complex and multi-faceted ranging from the quality of goods/services, business and pricing models, financial strength, market and competitive dynamics to the quality of execution by the CEO, executive team and employees in delivering to and supporting their customers day to day. While there has been a significant amount of academic research globally over the last 20 years which has demonstrated a strong correlation between board performance and company performance, many company boards still aren’t aware of the strong link between their own performance as a board team and their overall company performance. Most executives, board members and shareholders intuitively understand that when you look at a company performing at the top of its game, you inevitably will see an outstanding board team in the background closely supporting a CEO and executive team excelling in execution but also with the board team providing the highest levels of oversight and stewardship to ensure a long-term sustainable future for the company and its stakeholders. Conversely, we have all seen many corporate failures and companies overseeing significant destruction in shareholder value where you had a board team under-performing, in cruise-mode and either on an ongoing basis or at critical moments ultimately made poor major decisions which costs shareholders and stakeholders dearly.

A recent discussion with the board chair of a large company inspired me to reflect on this area and write this article. In a discussion with the board chair, he indicated that the board annual agenda was so full for this coming year that the board team had no bandwidth for any initiatives to actually measure and improve their board effectiveness and performance. I then posed the question “what if actually improving your board team’s effectiveness and performance led to a tangible improvement in your company performance, would you re-consider the priorities of the board and make room for measuring and improving your board team’s performance ?”. The board chair responded by saying “Absolutely but how clear-cut is that correlation as I would need to be convinced”. This is quite an experienced board chair leading a solid board team and his perspective on this is exactly why so many boards are in the “average and functional” bucket of board performance and why there are so relatively few exceptional board teams.

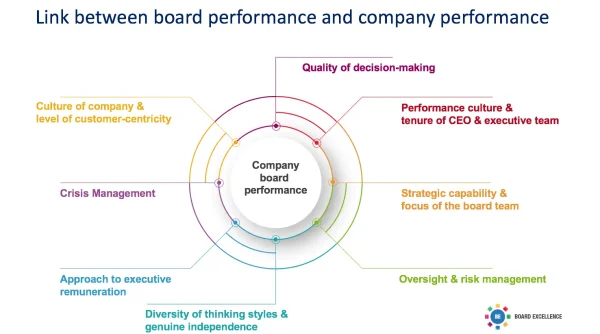

In my experience, the following factors outlined in the following diagram and discussed below, represent the key areas of the board’s performance which ultimately have an impact on the overall company performance. While a number of these have particular relevance for publicly-listed companies, most are common to all company boards irrespective of scale and shareholder structure.

Quality of decision-making

A company board is ultimately judged by the quality and outcome of the major decisions it makes. While clearly its overall oversight and stewardship roles are crucially important areas, major decision-making is a fundamental role of the board and getting these right or wrong has significant ramifications for the company. These major decisions could be to replace an under-performing CEO or to stick by a struggling CEO, to give the green light for a major acquisition, to commit significant company funds or take on substantial debt to fund new product development or enter new markets, to ensure the company is properly focused on ensuring the appropriate level of investment and priority to protect the company and by extension its customers against major cyber-security threats. It is at these moments that the true quality of a board team is revealed and the process by which a board team goes through to arrive at and optimise decision-making speaks volumes about a board team. This is where the highest levels of robust challenge and debate between an extremely open CEO/executive team and genuinely independent diverse high-calibre non-exec directors, pushing each other hard to maximise the collective intellectual firepower and experience of the board team “to see around dark corners”, results in the board team being able to make an optimal balanced decision.

Performance culture & tenure of CEO & executive team

One of the common denominators of outstanding board teams is the performance culture within the board team itself and the high bar that is set for the CEO and executive team. Given the critical impact the performance and execution of the CEO & executive team has on the company day-to-day, these board teams balance the highest levels of oversight of the CEO and executive team with the non-exec board members adding genuine value and providing tremendous support to the CEO & executive team, both at and importantly in between board meetings. This has resulted in a far more dynamic approach being taken to CEO performance assessment and in addition to the traditional annual CEO performance assessment, the board chair and non-execs are providing far more regular feedback to the CEO and actively helping the CEO strengthen in key areas. The decision to replace or stick by a struggling CEO is one of the most difficult challenges any board faces, particularly where the CEO is a founder and/or is a mercurial visionary type CEO who in the eyes of customers, employees and investors, represents the “soul and heartbeat” of the company. This decision has major ramifications for the company’s future and many boards have got this spectacularly wrong with either prematurely taking out a CEO or as in many cases sticking by a struggling CEO for too long.

Strategic capability and focus of the board team

Every board team, irrespective of the scale of the company and experience of the board team, is facing unprecedented challenges in terms of formulating and evolving its company strategy to deal with incredible levels of disruption in each market segment, the impact of technology disruption, radical new business models, geo-political risks such as Brexit, looming trade wars and a levelling of the playing field in terms of new entrants to markets. A strong board team understands both the huge efforts needed to formulate a winning strategy as well as the significant implications on company performance, both short term and longer-term. Therefore they operate in a “high-gear strategic mode” with all board members genuinely contributing to and actively involved in the strategy area and ensuring that the board are not distracted by deep-diving into the weeds of operations and finance which so many board teams are prone to. This is also where high-calibre independent non-execs with deep industry expertise can come into their own in terms of challenging and adding to strategic options developed by the executive team as well as in some cases bringing serious left-field new strategic thinking to the table. Group-think is a real problem that can seriously impact strategic decision-making in a company board and it is only in the depths of despair where a board team got a big strategic call horribly wrong do they realise that the genuine quality of their initial strategic discussions may have actually been quite poor and myopic.

Oversight and risk management

It seems baffling that despite the harsh lessons learned from spectacular high-profile corporate failures in the last twenty years, the scale of external audits and the major strengthening of corporate governance codes that we are still witnessing corporate failures such as Carillion and Patisserie Valerie. Unfortunately, I do not see the threat of these corporate failures reducing anytime soon and that is why now, more than ever, shareholders and stakeholders are relying so much on the board to be the first line of defence in terms of identifying serious internal and external issues that threaten the financial and overall health of the company. Risk management and internal controls are not the glamorous part of companies but yet the consequences of when boards are either asleep at the wheel or lack the required expertise in the non-executive directors and sub-committees, can be profound and in some cases, fatally damage a company. Cyber-security is a prime example – despite the incredible publicity in the media on a daily basis of major cyber-breaches and incredible damage to brand and customer relationships, so many company boards from sizeable private companies to PLCs are absolutely sleepwalking in terms of not making time for the board to properly ensure on behalf of its shareholders that the company is making the appropriate investments and has the right operational and executive focus to optimally protect the company.

Diversity of thinking styles & genuine independence

In a recent article for the Chartered Accountants of Ireland, I was asked to imagine what a board of directors would look like in 2025. In the article, I describe a board meeting where the board chair Julianna, leads a board team of nine board directors, five female and four male, with an average age of 46 and where every board director had been selected purely on merit, not who they know but what value they can bring to the board team. I talk about each board director having a maximum of two three-year terms which would be an integral part of continually refreshing the board and ensuring there was a wide diversity of thinking styles and genuine independence amongst the non-executive directors. So many board teams genuinely miss the point on board diversity and don’t realise the incredible value that improving the board diversity ( gender, age, ethnicity, professional background, socio-economic background etc. ) and level of genuine independent thinking brings in terms of improving decision-making, increasing the level of challenge & debate, avoiding damaging group-think and importantly injecting new blood and energy into what in many cases may have become a jaded board team going through the motions, performing at a level way below what shareholders would expect and deserve given the CVs of board members and executives around the board table and that the board team is far from being at the top of its game excelling for shareholders and stakeholders.

Approach to remuneration

The area of executive remuneration, how executive pay compares with average employee pay and how executives are rewarded both in good times and in periods of poor performance, has become one of the hottest battlegrounds in terms of investor shareholders and their portfolio boards. At a time of growing focus on ESG ( Environmental, Social and Governance ) factors by institutional investors and the level of global soul-searching on the merits of company performance being narrowly defined in pure financial terms only, company boards and Remco committees are realising that the set-up and “perceived fairness and appropriateness” of executive pay structures has far broader implications than the executive sphere. There is no shortage of serious well-respected research that is seriously calling into question the traditional theory that over compensating company executives correlates to increased company performance. Progressive board teams and Remco committees are starting to step back and re-think their traditional approaches to executive compensation to ensure that there is an appropriate balance of competitive executive pay structures and that in the eyes of all shareholders, employees and stakeholders that the design of executive pay “looks balanced and feels right” and genuinely aligns with the desired culture and values of the company.

Crisis Management

In the lifetime of most companies, crises will happen. This could be a significant loss of market share due to the competitive landscape shifting or a radical new business model introduced by a competitor, serious quality problems, a major cyber-security breach or a crisis in confidence in the CEO and executive after a string of poor results. Even the best-run companies can face a serious crisis. How a board team deals with a crisis has profound implications for the knock on impact to the overall company performance, both in the short term and medium/longer term. The strongest board teams stand up and are counted when a crisis comes knocking on the door. They will act decisively, roll up the sleeves to understand the ramifications, strategise very thoughtfully and carefully on the options open to the board to address the crisis, where appropriate liaise with major shareholders, formulate and drive a concrete plan. Where you see a company buckling under a crisis or see the company go into “head-in-the-sand-mode” in denial as to the true seriousness of the crisis and thrash about, you can rest assured that in many cases the crisis has exposed a weak board that is not able to cope. Unfortunately for shareholders and stakeholders, it is usually too late to finally realise that the board was simply not strong enough.

Culture of the organisation and level of genuine customer-centricity

In terms of buzz-words for company boards internationally right now, “culture” and “tone at the top” are right up there. There has been quite correctly a major increase in focus on the culture of companies, its behaviour, integrity and values, how does the company treat its employees, its customers, its suppliers, hour-to-hour, each day. Quite a lot of company boards simply pay lip-service to the culture, behaviour and values in their company organisation and while they will say all the right things in the company, shareholder, marketing and employee communications, the actual reality of how much genuine emphasis the board puts on culture, how it engages and partners with employees, how it genuinely sets the example for all employees in terms of how the board team embodies and lives day to day the desired culture, behaviours and values can be very far from that portrayed in the glossy annual report. On the other hand, there are board teams and companies who genuinely put a high-integrity culture at the heart of everything the company does from how they treat employees to how they treat their customers. I believe we are entering an age where in a time of decreasing differentiation between companies products and services, employees, customers and institutional investors will increasingly gravitate to those companies that actually have integrity and ethics coursing through its veins, where employees are excited and inspired to go the extra mile for their customers, investors are proud to tell their own shareholders about why they have invested in this company and from the board team to the most junior employee, there is a genuine commitment to consistently demonstrate the desired values and behaviours day to day where “doing the right thing” is always encouraged and where the long-term sustainable future for the company is not simply about next quarter’s profit margin. The best board teams recognise this and “walk the talk” in terms of culture.

Summary

I believe there is a very strong correlation between the performance of a board team and the company performance. Where you have an exceptional high-performing board team working extremely well with the executive team, extremely sharp in terms of strategic thinking, where the highest levels of debate, challenge and oversight are combined with diverse high-calibre non-executive directors adding serious value to the executive team, you have a powerful foundation to enable sustainable company out-performance. These board teams genuinely recognise the importance of culture, setting the example in terms of their own behaviours and in areas like executive compensation. In contrast, many companies who are seriously struggling, have under-performing ineffective board teams who are ultimately letting down the shareholders, employees and stakeholders. All too often, it can be very convenient to scapegoat a CEO when the board team itself realises, despite the great experience and reputations around the table, that their own performance simply isn’t good enough. I believe the genie is truly out of the bottle and the current increasing levels of scrutiny and expectations of a company’s board team by investors and stakeholders will continue to grow. The best board teams will be very comfortable with this focus on them as their natural default position is to continually improve and excel for their shareholders and stakeholders. The shareholders, employees and stakeholders of a company deserve no less from their board team to whom they have entrusted a very significant responsibility.

Kieran Moynihan is the managing partner of Board Excellence ( https://boardexcellence.com) – supporting boards & directors in Ireland, UK and internationally excel in effectiveness, performance and corporate governance.

Think your business could benefit from our services and expertise? Get in touch today to see how we can support your board excel for its shareholders, employees and stakeholders.