If it does, you are not alone as the vast majority of boards, from the smallest to the largest companies, organisations and non-profits, really struggle in this area and often feel stuck in a groundhog day cycle of all the board meetings being consumed by endless deep diving in operations and finance. It’s important to say at the outset that this is a very natural and understandable problem. Each non-executive board member has to balance the responsibilities of overseeing the performance of the executive team, safeguarding the financial/legal health of the organisation, discharging your statutory & fiduciary responsibilities as a board member with genuinely adding value in constructively supporting the CEO & executive team to achieve the organisation’s objectives.

In recent years, the standards of corporate governance and national company/director law globally have correctly continued to strengthen with the result that the weight of legal, fiduciary and ethical responsibilities on the shoulders of board members has increased dramatically. Shareholders/Stakeholders have a critical dependency on the ability of board members to monitor executive team performance and are counting on their ability to put two and two together as the frontline defence against a breakdown of financial health, operational performance or a concentration of risk. High calibre board members get below the surface in order to understand effectively financial health, operational performance and risks. Provided the board information management is high and the right set of KPIs are being utilised, a highly effective monitoring approach, beyond standard operating/financial performance is also a significant value-adding activity that taps board members incisiveness, instincts and expertise to alert management to problems in the making and threats on the horizon.

The serious downside however of continually getting bogged down in the weeds of operations, performance, finance, sales etc. is that it robs the board of the bandwidth to add serious value in the areas of strategy, risk, cybersecurity, talent development, succession planning, board performance etc. High-performance boards have developed the ability through a lot of hard work & discipline to effectively balance doing an excellent job on their oversight responsibilities with adding serious value on behalf of the shareholders/stakeholders in key areas such as strategy and risk. These boards have recognised the following factors which contribute to the “gravitational pull” of the board into operations and finance deep diving ;

Quality of the Board information model – many board members really struggle to find high-quality information in the labyrinth of many modern day board packs. In sifting through tomes of detailed data with little or no executive summaries highlighting the critical information, non-exec board members will invariably gravitate to asking a lot of detailed questions at the board meeting.

Timing of board-pack – many CEOs often are frustrated by relentless questioning at the board meeting on areas covered in the board pack. When I ask them when was the board pack sent out, they would indicate “yeah, we only sent it out 24 or 48 hours before the board meeting ( shorter in some case !) but we’re all on planes, there is so much going on and we were waiting to add some key sales data into the pack”. Even a simple step of ensuring that the board pack goes out 5 working days in advance can ensure proper time to prepare effectively and any breaking news can be added in on the day.

Quality of preparation – it’s vital for the non-exec board members to really put the work in and prepare effectively for the board meeting. This ensures that their engagement and questioning of the CEO & executive team is effective and strategic.

Comfort zone in numbers – many non-exec board members have a financial background and thereby are susceptible to having a comfort zone in wading through the numbers and trying to understand what exactly is the origin of the value in Excel field AA73 and why is it off by 1% ! They can struggle in strategic areas and sometimes it can suit the CEO for them to only focus on the numbers.

Balance of presentations & quality of Q&A – a key trend in highly effective modern boards is to reduce the time executives spend presenting, utilising high-quality executive summaries and to increase the level of effective & strategic Q&A.

Trust & partnership between execs and non-execs – where a genuine trust has been built between the CEO/Executive team and the non-exec board members, the board team develops a highly effective capability of working through the detailed performance and operations areas, deep diving where genuinely appropriate but ensuring the discussions are extremely effective.

Track record of CEO & executives on red-flag issues – where a CEO & executive team have demonstrated a genuine track record of the highest level of transparency and openness on flagging performance issues, serious risks, negative trends, red-flag issues etc., it enables the non-exec board members to discharge their legal and fiduciary responsibilities in a far more effective manner.

Chairman leadership – the Chairman has a key role in both the design of the agenda and the management of the board meeting to ensure that there is an optimum balance between the operational/performance/finance areas and key areas such as strategy, risk and talent development.

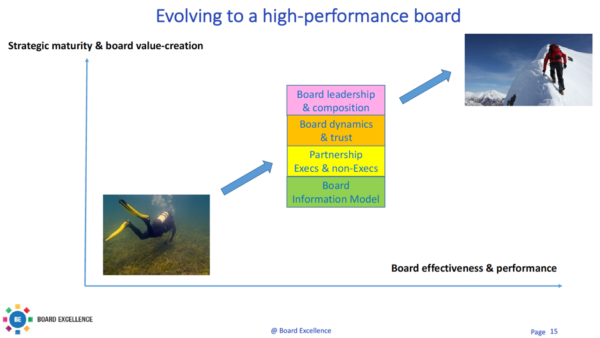

Many board members have asked me over the years as to what really distinguishes the highest performance boards from standard boards. A key factor I outline is that through focus, discipline and hard work by all board members, these boards evolve from “scuba-diving mode” to “strategic mountain climbing mode” while still doing an outstanding but highly effective job on their legal and fiduciary oversight responsibilities to safeguard the shareholders’ interests. The following diagram from our board best practices workshop highlights this journey ;

In summary, nothing will ever change the critical responsibility of board members to discharge their legal, fiduciary and ethical responsibilities to provide oversight of the executive team and particularly for non-exec board members to be the frontline defence against a breakdown of financial health, operational performance or a concentration of risk. However there are best practices now proven by high-performance boards that you can deliver on that responsibility in a highly effective manner that will also ensure the board has the proper bandwidth to genuinely add significant value to shareholders in key areas such as strategy, risk, talent development and board performance.

Kieran Moynihan is the managing partner of Board Excellence ( https://boardexcellence.com) – supporting boards & directors in Ireland, UK and internationally excel in effectiveness, performance and corporate governance.

Think your business could benefit from our services and expertise? Get in touch today to see how we can support your board excel for its shareholders, employees and stakeholders.