A company board chair asked me late last year for guidance on a dilemma he was struggling with in terms of one of his strongest non-executive directors coming up to the nine-year milestone which is the point at which the UK corporate governance code stipulates that serious justification is needed to show that a non-executive director continues to be independent. The board chair acknowledged the board had not been refreshed in years, diversity was poor, the sector expertise around the board team was getting very dated in the light of major technology impacts on their services sector and that this was the first of several long-serving non-executive directors coming to this milestone. I indicated to the board chair that in my experience, board chairs need to apply an 80:20 rule when it comes to long-serving board directors whereby 80% of the time, the board chair should take the opportunity to refresh and where needed strengthen the board for the next phase of the journey and that in less than 20% of cases would have you have a situation where you could justify an exceptional non-executive director who continues to make a very strong strategic contribution to the board continuing for an additional fixed period of time.

The board chair wasn’t thrilled to hear this guidance as he felt it reflected poorly on his lack of succession planning and his general reluctance to bite the bullet and properly plan for a thoughtful refreshing of several of the non-execs over the coming years. He also struggled with the personal implications for him in telling a long-serving board director that he/she needed to move on after serving with them in the trenches over many years and building a trusting relationship. He ultimately decided that it was in the best interests of the board team for the long-serving board director to step down, he utilised the opportunity to plug a serious skills gap they had in the board and the board chair reluctantly admitted to me recently that the new non-exec has been a welcome refresh on the board ! This is precisely what outstanding board chairs do to ensure there is a very vibrant diverse team with the mix of skillsets and expertise needed to drive sustainable long-term success for the next phase of the organisation’s journey.

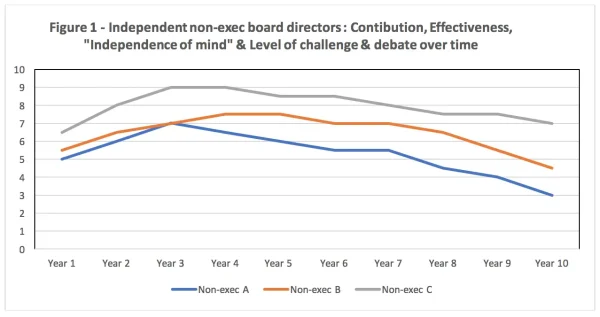

How a board handles long-serving board directors has a significant impact on the board’s effectiveness and performance. In a significant number of cases, board directors are left in place far longer than they should and this often results in in-effective stale boards with very poor diversity, poor levels of genuine dynamic robust challenge and debate and a far greater potential for group-think problems. It is with very good reason that the UK and national corporate governance codes and non-profit/charity/state governance codes all around the world stipulate strong guidance on independent board director terms as invariably there is no shortage of examples of long-serving board directors gradually losing their “independence of mind”, getting too close to the CEO and executive team and over time losing their curiosity, allowing their commitment to upskilling fade and losing the spark that many high-quality independent board directors have in their early years of serving on a board. Figure 1 below highlights three typical board director profiles I have seen over the years in terms of how their “independence of mind”, contribution and levels of challenge and debate change over the years.

The vast majority of non-exec directors fall into categories A and B where inevitably as the years go by, their overall contribution, effectiveness, “independence of mind” and the level of challenge and debate they provide to the CEO and executive team can diminish. Type C is absolutely the exception where you have an outstanding non-executive director who maintains a consistently high standard of contribution and effectiveness despite the passing years, is continually refreshing her skills ( particularly in the case of an industry-specialist non-exec director ) and still has a very balanced relationship with the CEO and executive team whereby the CEO and executive team absolutely know that she still has a very burning commitment to the shareholders/stakeholders to maintain the highest levels of challenge and oversight and will not hesitate to engage in very robust high-quality debate and challenge.

It’s very important to highlight that this fall-off in these attributes over the years is very human and very understandable. As a board director builds a relationship with the CEO, executive directors, board chair and other non-exec directors and a board team settles into a “groove” and levels of respect and trust grow, over time it can be very natural for their “independence of mind” and their commitment to high-quality robust challenge and debate to slowly decline. The problem is that where the board is not refreshed at regular intervals and this “creeping decline” sets in across all the board members, it inevitably impacts on the board’s performance and in many cases the board don’t even realise it. This is actually one of the reasons that the strongest board teams are the type that undertake external board evaluations most often as they realise that together with regular refreshing of the board composition, this is a critical mechanism to keep the board absolutely on its toes and prevent a creeping decline in the overall effectiveness and performance of the board.

It’s also important to highlight that this long-serving challenge also applies to board chairs and if anything, the stakes are a lot higher when it comes to a long-serving board chair due to the dis-proportionate impact of their leadership on the overall board effectiveness and performance. I have seen several cases of boards lose their way due to a long-serving board chair whose overall leadership and effectiveness has been gradually declining and staying on sometimes for several years beyond the point at which a new board chair should have been appointed. This is no reflection on their commitment and work ethic over many years to the organisation but a lot of board chairs will be the first to put their hand up to say they struggle with their own succession planning. This is also where a high-calibre “senior independent director (SID)” and a board nominations committee have a key role in ensuring that there is a proper succession plan in place for the board chair and a very well planned transition plan. Just like non-execs, I have seen genuine compelling cases for a fixed duration extension for a long-serving board chair.

In Figure 2 below, I have highlighted criteria and key consideration areas we have helped board chairs, SIDs and nominations committees with in terms of best practices for addressing the challenges, dilemmas and importantly the opportunities that present themselves in terms of long-serving board directors. As per the 80:20 rule outlined above, I believe it should be only in exceptional circumstances that the board should allow a long-serving board director and board chair to continue beyond the recommended timeframe for the board involved. A genuine compelling case needs to be built to explain to the shareholders/stakeholders why it genuinely is in the best interests of the organisation for a fixed extension to the board-chair/non-executive board’ director’s term. Every time a board leaves a long-serving board member in place it is often at the expense of adding a new non-exec director who could bring substantial diversity, new skill sets and expertise as well as refreshing new energy and enthusiasm to the board team.There are three specific cases I have seen where there is genuine justification for this ;

- An exceptional industry and sector specialist who continues to make a very strategic contribution to the board and executive team, who is continually refreshing their expertise, understanding of the market/sector, competitive understanding and “moves the needle” in terms of the board’s strategic firepower – these are very hard to replace and this needs to be incorporated into succession planning thinking

- An outstanding board chair or non-exec director who continues to operate at the highest levels of independence and effectiveness and are a corner-stone of an outstanding board team

- The organisation is either in or entering a very challenging or transformative phase ( e.g. major re-structuring, significant M&A activity, severe challenges and organisational performance issues ) where the board and shareholders collectively need the board chair and specific non-exec director to play a critical role in this coming phase before they ultimately step down ( important that this doesn’t become a series of “exceptional phases” where there always seems to be justification for further extensions ! ).

Stipulations and guidelines in the organisation’s constitution

Many organisations have built in very specific stipulations and guidelines which govern the handling of long-serving board members. While this is particularly prevalent in non-profit, charity and public sector boards, I have seen some company boards mandate very specific handling of long-service board members approaching key term milestones and have a key focus on high-quality succession planning where well in advance of key milestones, the board chair and nominations committee are very thoughtful in identifying new board director candidates. In some cases, boards and major shareholders have asked for these requirements to be in place in the constitution as a result of serious problems in the past whereby in particular board chairs stayed on too long and the board’s effectiveness and performance was compromised as a result of this

Governance code requirements ( national and sector-specific )

In the latest UK corporate governance code and in the UK FRC Guidance on Board Effectiveness, there is a very substantial emphasis placed on the nine-year stipulation for board chairs and independent non-executive directors. This is mirrored in governance codes across the world and is particularly relevant in the case of publicly-quoted companies. As well as the ongoing requirement for board directors to be re-elected each year, there is a growing emphasis placed by institutional investors in particular and general shareholders on the bar needed to be set a lot higher to justify board directors staying on beyond the recommended term. In a number of non-profit and charity sectors, there are very specific requirements set on board terms. One trend I have noticed in several countries is two three-year terms for all board directors on charity and non-profit boards with the board member transitions being carefully staggered to ensure an appropriate level of continuity. I can see the potential in the coming years for the nine-year stipulation in the UK corporate governance code to reduce further to six or seven years to support higher diversity and refreshing of board teams.

Diversity and refreshing the board

One of the main reasons why diversity has been such a challenge for boards around the world is the stubborn refusal of many boards and their board chairs to genuinely refresh the board composition particularly when the opportunity arises when long-serving board are approaching the end of their recommended term. There is still a significant portion of boards in all sectors whose board chairs do not see the value of diversity, do not recognise the value that female and younger non-executive board directors would bring to the board team, do not appreciate that the board has become stale and stubbornly sticks to a legacy model of a board where in many cases, board directors are being allowed stay on beyond the recommended guidelines. Many boards have poor levels of technology expertise on the board and often mishandle significant technology disruption in the customer and competitive landscapes as well as serious cyber-attack threats/crises. It is almost like these boards are stuck in a type of “time-warp” whereby they are not recognising or respecting the important need of their shareholders and stakeholders to have a very dynamic highly diverse board team that is regularly refreshed, that has the right skill-sets and expertise for today’s market, the market over the coming years and which has the energy, enthusiasm and “fire in the belly” for the board team to add the highest levels of value and stewardship to the organisation as part of nurturing sustainable long-term success for the organisation. I have also seen cases where a CEO, supported by the board chair, would push for long-serving board members to stay on even though they know the board director’s contribution and effectiveness has fallen off considerably. This is driven by a desire to avoid new non-exec directors coming in and “rocking the boat” in terms of vibrant challenge allowing the status quo to continue whereby a controlling CEO has “the non-execs in his pocket”. This is not healthy for the board.

Skillsets and expertise required by the board

Progressive board teams use the opportunity provided by long-serving board members stepping down to assess in a very thoughtful way the skillsets and expertise that will require going forward. This may be a non-exec director with deep expertise in emerging technologies such as AI and big-data or it may be non-exec director with a strong track record in a new geographic region of the world the organisation is moving into etc. This is succession planning at its very best where the board chair and nominations committee are at the very top of their game ensuring that every single board seat is occupied by outstanding board directors who bring very complimentary and unique skillsets to the board team to help the board navigate over the coming years an increasingly un-certain volatile market landscape. I have seen cases where industry specialist non-exec directors have not kept pace with the changing sector landscape, have not put in the hard yards to genuinely keep abreast of the evolving landscape and while once they brought significant value to the table, no longer do and in extreme case have become a weakness in terms of the value-add they are providing to the board and CEO/executive team.

“Independence of mind” considerations and avoiding “group-think” problems

In recent years, central banks and financial service regulators have put a huge emphasis on “independence of mind” for independent non-executive directors of financial services organisation to ensure the highest standards of corporate governance, decision-making and effective boards. The critical importance of “independence of mind” however applies to all boards and as outlined in the opening section of the article is a key consideration for long-serving board members. As the relationship and bonds build over the years between non-executive directors and the CEO/executive team, the propensity for long-serving board directors and board teams that haven’t changed in years to enter the “zone of un-comfortable debate” often declines. This can be a very gradual and creeping decline that unfortunately represents the sowing of the seeds for potentially serious group-think problems and in some cases, poor decision-making. This is a fundamental reason for periodically refreshing the board and is a key focus for external board evaluations where an experienced evaluator can piece the jigsaw pieces together to understand the current levels of challenge, debate, oversight and to make recommendations to enable a vibrant healthy level of “independence of mind” that is a corner-stone of high quality oversight by the non-exec board directors.

Commitment and work-ethic

I always encourage board chairs to set the bar very high on the commitment and work-ethic of each board director. As outlined above, a significant number of board directors struggle after many years of service to maintain the same levels of commitment and work-ethic. Sometimes this translates to long-serving board members “just doing enough” and from a board chair perspective, this is simply not good enough and in terms of a board director coming to the long-service milestone, it’s a very easy decision.In a related problem of non-exec director “overboarding” I have seen non-exec directors shape their commitment and work-ethic to each board inversely proportional to the length of service devoting most energy to newer board roles – no board should put up with this, irrespective of what “CV” the non-exec director has.

Curiosity and continual upskilling

In my experience, the very best non-exec directors have a great “curiosity” about both the company/organisation and the sector it operates in. This translates to not only very thoughtful and sometimes creative left-field challenge and strategic ideas to the CEO and executive team but it also ensures that the non-exec directors are continually modernising their skillset, expertise, embracing new technologies and developments in their sector. This is vital for the board team as it ensures that the board’s non-execs are properly equipped to help and challenge the executive team in terms of the evolving landscape, emerging changes in the competitive “balance of power” and helping the board team “see around dark corners” in terms of major threats to future sustainable success for the organisation. This is a key yardstick to justify a non-exec director staying on beyond the recommended term.

Contribution, effectiveness and performance

When all is said and done, the critical test for any non-exec director and board chair is their level of contribution, effectiveness and performance in their board role. Unless a non-exec director can hand on heart justify that their contribution as an effective high-performing director is at a high-level today and will continue for a reasonable fixed extension period, there is no basis for that board director staying on and it is absolutely incumbent on the board chair to utilise that opportunity to refresh and strengthen the board irrespective of the relationship and the overall net contribution that board director may have made over their term of service. The priority is the overall board team and how best it can provide outstanding levels of leadership, stewardship and contribution to the organisation going forward.

Summary

Exceptional board teams have a very clear and pragmatic approach to the dilemma posed by long-serving board directors – they embrace the opportunity to refresh, strengthen and increase the diversity of thinking styles in the board team to ensure a very vibrant board team with high-quality challenge and debate at its core and the board having the skillsets and expertise to position it for sustainable success over the coming years. Only in exceptional cases should board teams leave non-exec directors and board chairs in place beyond best-practice recommended terms for the sector the organisation operates in. Too many boards have either inadvertently, through inertia/default or very deliberately left long-serving board directors in place whose level of contribution, effectiveness and “independence of mind” have declined, sometimes considerably. This over time results in a lot of stale boards with poor diversity who are prone to “group-think problems” and who simply do not excel on behalf of their shareholders and stakeholders. This is a core root cause of why we have such a challenging board diversity problem across the world. Contrary to the protests of board chairs indicating that there is in-sufficient calibre of female and younger non-exec directors to draw from, my experience is that there is a strong cohort of female non-exec directors and younger non-exec directors out there and the progressive board teams have the foresight to recognise this and utilise the opportunity provided by long-serving board members stepping down to strengthen and refresh the board to help position the organisation for long-term sustainable success.

Kieran Moynihan is the managing partner of Board Excellence ( https://boardexcellence.com) – supporting boards & directors in Ireland, UK and internationally excel in effectiveness, performance and corporate governance.

Think your business could benefit from our services and expertise? Get in touch today to see how we can support your board excel for its shareholders, employees and stakeholders.

.